Can I use my Gateway Green Loan for solar panels?

Solar panels are the way of the future, and Australian homeowners know it. As of June 2023, more than 3.5 million systems, representing almost one-third of Australian households, had officially installed solar panels – marking the highest rate in the world! In 2021 alone, more than 360,000 people had solar panels installed on their rooftops, and the numbers continue to climb.

Australian homeowners are choosing solar panels for a few key reasons:

- Lower energy bills: On average, solar can save you around 25-30 cents per kWh for time-of-use billing or 22-28 cents per kWh for flat-rate power

- Clean energy generation: Solar panels use energy from the sun to generate clean electricity. In 2020, small-scale solar systems generated 23.5% of Australia’s clean energy

- Generous government subsidies: In 2023, the government subsidised about $396 per kW installed or $2613 off a typical 6.6kW system. This number changes from year to year, so be sure to check in with your solar panel installation specialist

Funding solar panels is easier than ever, and Gateway has a range of loan options to support members looking to install solar systems in their home. Here, we share helpful tips and information on how you can use our Green Loans for solar panels.

About our Green Home Loans

At Gateway Bank, we reward customers who are taking steps to make their home more energy efficient. Our Green Home Loan offers a 0.15% pa discount on our Premium Package Variable Rate Home Loan, complete with 100% offset and redraw. Furthermore, our Green Plus Home Loan offers a 0.25% pa discount for homes certified as energy efficient.

These home loans are ideal for customers who:

- Own a property with established sustainable features

- Are planning renovations to add sustainable features

- Are planning to build an eco-friendly home

So, if you’re planning to renovate or build a new environmentally friendly home, consider leveraging our green home loans to fund solar panel installation.

Alternatively, if you already have solar panels and other sustainable features resulting in a Residential Efficiency Scorecard rating of seven stars or higher, you could be eligible for larger discounts through our Green Plus Home Loan!

How to use our Green Loans for solar panels

Intrigued by the prospect of adding solar panels to your existing home or new home build? There are several ways to qualify for our Green Home Loans and get the financing you need for solar panel installation. Here’s a quick guide.

Gain a Residential Efficiency Scorecard Certificate

Whether you already have an energy efficient home or plan to integrate sustainable features to an existing property, you will need to obtain a Residential Efficiency Scorecard Certificate from an accredited assessor to qualify for our Green Home Loans. You will also have to achieve a Residential Efficiency Scorecard Rating between 4 and 6.99 stars, while a rating over 7 stars qualifies you for our Green Plus Home Loan.

A Residential Efficiency Scorecard Rating is kind of like the energy rating label on your fridge, dishwasher or washing machine. The higher the rating, the lower your annual energy costs.

Your Scorecard will help you understand your home’s power consumption and identify necessary changes for a more sustainable future.

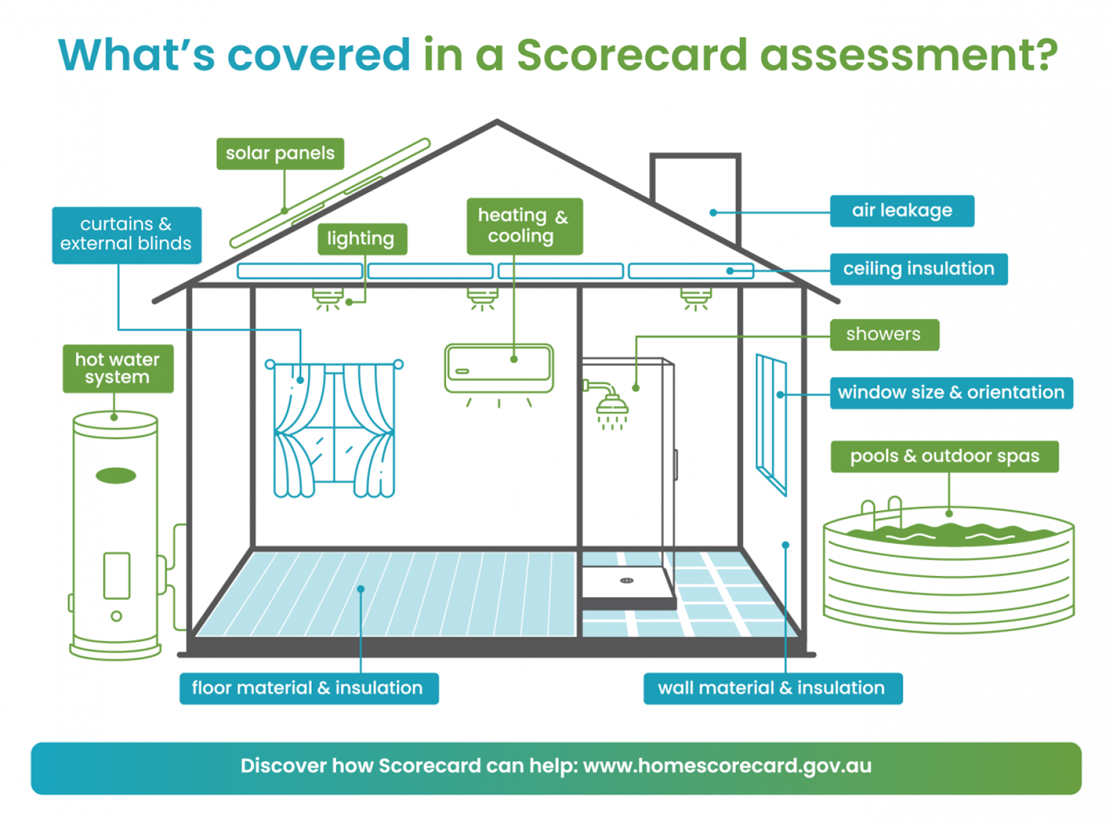

To obtain a Residential Efficiency Scorecard Certificate, an independent assessor will conduct an on-site assessment of your home, considering your sustainability goals, pinpointing pain points, and providing an energy efficiency score based on your home’s fixed appliances and features, as listed below.

Source: homescorecard.gov.au

Source: homescorecard.gov.au

While the score ranges from 1 to 10, you only need to achieve a score between 4 and 6.99 to qualify for a Gateway Green Home Loan. For some perspective, a Scorecard Assessment usually costs between $250 and $500, a small price to pay for the savings that come with a Green Home Loan.

Have at least three existing sustainable features on your property

In addition to meeting standard credit criteria, your home must possess at least three environmental features to qualify for a Gateway Green Home Loan. This goes for purchasing an existing house, refinancing, or constructing a new one.

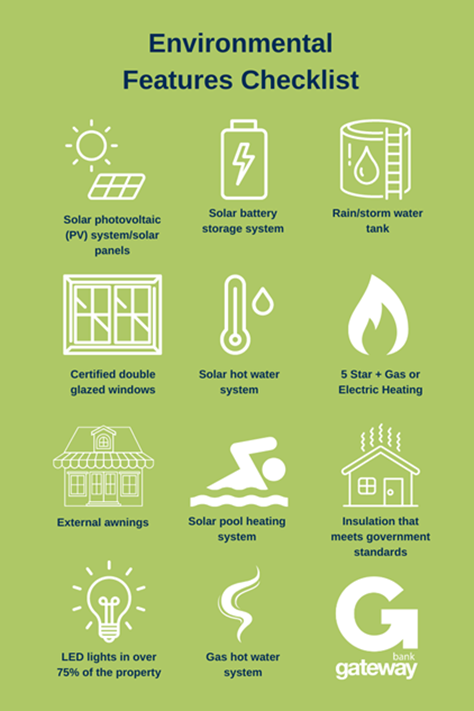

Here’s a checklist of environmental features required to qualify for our Green Home Loans:

You may also have a split system, evaporative cooler, or star-rated zoned air conditioning unit with either a minimum energy rating of 4/6 stars or a minimum of 6/10 stars.

As long as you meet the criteria mentioned above, you can use our Green Home Loans for solar panels and a diverse range of other sustainable features, such as solar hot water systems, pool systems, rainwater tank installation, double or triple-glazed windows, and so much more (within 12 months of the loan funded date).

Refinancing can also extend to changing the loan’s duration. Opting for a shorter loan term could translate into higher monthly payments, but it will help you clear the debt much faster, with less interest paid overall.

Good for your pocket and the planet — reach out to Gateway Bank about our Green Home Loans!

Installing solar panels isn’t just a trend; it’s essential for reducing power bills, generating cleaner electricity, and investing in a healthier, more sustainable future. Gateway’s Green Home Loans are designed to simplify energy efficient home improvements. Get in touch for more information about our Green Home Loans or apply online today.